9 years ago we sold our house and cleared off all our debts.

4 years later we were once again in debt to the tune of £22,000 (more if you added the overdraft which we seemed to be in most of the time).

I kept thinking that I’d have a windfall through my business and be able to pay it all off again.

Eventually I realised that wasn’t going to happen and I needed to change the pattern of overspending that was causing the debt.

It was time for radical action – and I embarked on a journey of financial empowerment. This was really a series of simple steps I followed consistently.

Within 3 years the debt was gone –

When I look back, the whole experience was fun and my relationship to money was joyful and felt abundant.

And what struck me more than anything was how quickly things shifted.

It didn’t take years to dig us out of a financial hole – it wasn’t a never-ending journey.

It took just three months to curb the habitual over-spending which caused the debt. Three months to shift 30 years of deeply engrained money patterns.

Up until that point, I had never appreciated just how crucial money management was for a wealthy life. Looking back, it’s easy to see that I would never be trusted with more when I didn’t take of what I already had.

3 years later we were debt-free without hardship and were still able to go out, go on holiday and have treats.

And we’ve remained debt-free ever since.

As I reflect on that journey I’ve broken the steps down into the following 9 steps:

10 Steps to becoming Debt Free

Step One: Commit to your Debt-free life

This might seem obvious but in truth financial freedom is something we often pay lip-service to. It’s something we often put off until “tomorrow” or until “we have more money”.

Decide to start today and follow that up with action. Commitment is not passive. Simply saying you’re committed doesn’t change anything. I might be committed to travelling to Edinburgh but unless I get in the car or jump on a bus or train heading in that direction I’ll never get there.

As William H. Murray so wisely said:

“Until one is committed, there is hesitancy, the chance to draw back, always ineffectiveness. Concerning all acts of initiative (and creation), there is one elementary truth, the ignorance of which kills countless ideas and splendid plans. That the moment one definitely commits oneself, then providence moves, too. All sorts of things occur to help one that would never otherwise have occurred.”

Step Two: Track your Finances

Before we begin tackling any debt you need to get a handle on your finances.

Create a spreadsheet so you can start tracking every penny in and every penny out. This spreadsheet also becomes your cashflow forecast so you start noticing those times that would normally have you reach for your credit card.

It’s a very simple spreadsheet with a column for the date, income in, expenses out and what each is for. For example:

You can download an Excel template to do this over on my website at https://www.melinaabbott.com/10-steps-to-becoming-debt-free/

Begin by taking your most recent bank statement and entering all the transactions you’ve got coming up for the next 30 days next to the appropriate date. Add your regular income, standing orders, direct debits and all your regular payments. For things that aren’t a fixed amount – like a weekly food shop, put in an approximate figure on the date you’d normally pay .

This will give you an idea of your monthly payments in and out.

Don’t worry about any historical tracking – just start from today.

Do this this for each current account you own – whether that’s a personal, joint or a business account.

Step Three: Update your Tracker Daily

Every day, check your various accounts and update the spreadsheet with your actual spending. It’s important to do this daily so you get a feel for the flow of money. Add in any future transactions you know are coming up. Be mindful of where your money is going.

Energy flows where our attention goes. By focussing on money we invite more of it into our lives.

Step Four: Reduce your expenditure

It’s time for Austerity Measures.

Go through your expenses and cut back wherever possible. To avoid going into feelings of hardship or struggle treat it like a game. The more fun and light-heartedness you can bring to this, the easier it will be.

To help you, aim to do this for 3 months. 3 months is an easily achievable target whereas longer can feel depressing.

Here are 5 ideas to get you started:

- Subscriptions: Cancel any you’re not using. For those you do use, cancel them for 3 months and see if you miss them. If you discover you can’t live without them you can always re-subscribe.

- Non-essential expenses – cut back on everything that you really don’t need. For example, I stopped having my hair coloured at a hairdresser and instead bought a home colour. The children stopped buying school dinners and instead took sandwiches

- Avoid costly social events – no meals out, no going out for drinks. Instead invite people round to your house, you could have a picnic style dinner and ask them to bring something to munch on and something to drink. Scour your local area for all the free events and go to those. Find fun things that are low cost or no cost.

- Reduce your food shop. Choose a budget version of what you normally buy. Experiment with cheaper options wherever possible.

- Keep a record in your spreadsheet each time you save money – it’s fun to see it adding up,

Be ruthless. And remember, it’s just for 3 months – not forever.

Step Five: Stop spending on your credit card

Though obvious, it is much easier said than done. When I looked at my own debt, it wasn’t caused by buying frivolous or luxury items. It went on education and day to day living expenses. When our current account was low, out came the credit card. When I started to get serious about reducing the debt I concluded that we were over-spending by 1 – 2% per month. A tiny amount but it soon mounted up.

Make sure you use your tracking spreadsheet to assess future and potential purchases – add them to the tracker and see how they impact cashflow later in the month. Be discerning in what you purchase.

And be compassionate with yourself as you go through this process. Chances are that for the first couple of months you may still dip into your credit card. For me it was month 3 before I was able to stop using my credit card completely.

If may help cut up your cards, freeze them in a block of water or give them to a trusted friend.

Step Six: Assesses Your Debt

Now you’re aware of your everyday finances, it’s time to tackle your debt.

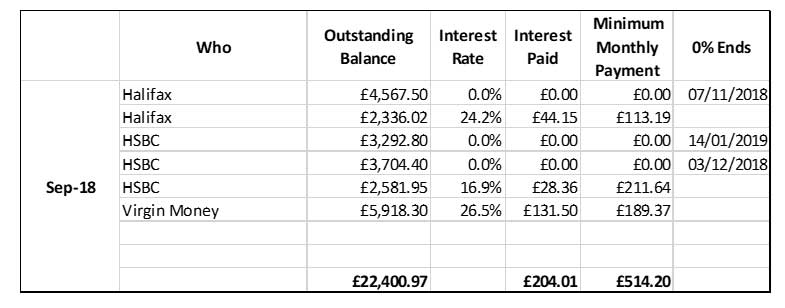

In another spreadsheet make a note of all your debt: who it’s with, the debt amount, the annual interest rate, the monthly interest, the minimum monthly payment and the date any interest free period ends. Include overdrafts, plus any money you owe to friends and family.

For example:

You can download this template, and a video of how it works, over on my website at https://www.melinaabbott.com/10-steps-to-becoming-debt-free/

It’s sobering to see it all in one place and see exactly what the debt is costing every month. In the example above £514.20 is going to debt repayments and a whopping £204.01 is interest.

Step Seven: Reduce Your Debt

Start by reducing any interest on your debt. In the example above there is £131.50 I interest alone being paid to Virgin Money. I was horrified when I discovered it. And of course, the interest is compounded as you pay interest on the interest.

So make interest reduction your mission. Here are 7 ways to tackle this:

- A balance transfer to another card with zero percent interest. You might not be able to transfer the full balance but any amount you can transfer will help. There will be a fee to do this but will be a lot less than the interest you’re paying each month.

- Consolidate the debt and put everything on to one low-coast loan with a lower repayment amount. If you do this, make sure you cancel your credit cards.

- Borrow money from a friend or family member.

- Negotiate a lower interest rate with your debt provider.

- Ask a family member or friends to gift you money.

- Use your savings if you have any.

- Contact the National debt line on 0808 808 4000 for advice for your specific situation

For example, in the scenario above let’s assume you can transfer £3000 to your Halifax card. This is what would happen to the repayments:

Whilst your overall debts may have increased by £50.63, you are saving £19.98 in interest repayments, and have reduced your monthly outgoings by £43.18 thus easing the burden of day-to-day living expenses.

For each debt pay off the minimum amount – except for one.

Decide on the debt you want to clear first. If you can’t make all your debts interest free, start with the one that has the highest interest. If all your debts are interest free, start with the one where the interest free period ends soonest.

Pay a set amount every month rather than the minimum. You will be able to assess how much you can afford by looking at your tracker. The more you pay, the quicker you’ll clear it.

Once this debt is cleared then transfer the amount you were paying to clear that on to debt two.

Pay attention to when the 0% finance ends and make sure you have a plan to move it. I became very adept at moving debt from one card to another – and back again.

It may also work out to be more cost effective to move it to a card that offers a low interest rate (for example 4 or 5%) but no transfer fee – so look at this option too.

Step Eight: Start Saving

Now that you’re consistently tracking, and all your debt is on a low or zero interest rate we can take steps to never have to dip into a credit card again. This is vital so you don’t revert to old patterns.

Every month just after you’ve been paid, review the month ahead and see what the lowest amount is – make sure you take into account all your budgeted expenses as well as fixed expenses.

When you see there will be a surplus, take half that surplus and put it in a savings account. Make sure the savings account is one that you have easy access to but is not connected to your current account.

When that big bill comes along, you’ll have the money and won’t have to put it on a credit card.

You also won’t be tempted to spend it. Before I did this I noticed that whenever it looked like I’d have money left at the end of the month, I felt rich and would end up treating myself to things I wouldn’t ordinarily buy – and the extra soon went.

Of course, if you’re still paying a lot of interest on credit cards put this money towards paying off your credit card first.

Step Nine: Increase your income

Brainstorm all the ways you could supplement your income. Do you have a skillset that others would pay for? A spare room you can let out? Are there things you’re not using that you could sell? If you’re employed ask for a pay rise or look for a higher paying job. If you run your own business, can you introduce a new product or take on more clients?

Use the extra revenue you generate to pay off debt.

Step Ten: Celebrate your Wins

Reducing debt takes time it’s important that you celebrate the huge strides you are making along the way so that you don’t get disheartened. Every quarter look at how much you’ve paid off and do something to celebrate. Go out for a lovely meal, buy yourself something new – spend some money on something you really want.

It may help you to stay motivated by deciding on what to do in advance as an incentive to stay on track when it gets tough.

And when that final payment on your last debt is paid – do something extra special to celebrate – you totally deserve it.

And there you have it, 10 steps to become debt free. When will you begin?

By Melina Abbott, Author, Speaker, Coach

Author Bio

Melina Abbott is a sales ninja, author and creator of the Sacred 6 Figures programme,

Melina Abbott is a sales ninja, author and creator of the Sacred 6 Figures programme,

after hitting 6 figures as a sales coach, she also hit burnout which led to rethinking her whole

approach. She now teaches other business owners how to sell in a way that lights them up and

aligns with their purpose.

Melina Abbott, founder of Sacred Selling, has been in business as a Marketing and Sales consultant

since 2004. It is her mission to transform the way we sell coaching services. Melina supports

business owners to align their business expansion with their spiritual growth; to shine a light on the

deeply rooted patterns and stories that still play out and that hold clients back. A Wife, and mother

of 2; she now lives in her dream home in Shropshire, England.

Find out more at www.melinaabbott.com

By Melina Abbott, Author, Speaker, Coach

Some really useful and implementable tips, thanks Melina! I remember when I first started tracking every penny I spent, for a whole year. It was daunting, but I quickly got in the habit and it was quite eye opening! This is a great reminder to get back into that habit, thanks!

I like the look of these trackers – thanks for an easy to follow step by step approach!

What an insightful article with such practical and straightforward steps.

Great mix of practical advice, personal experience, examples, and downloadable trackers. And not forgetting the inside stories and money patterns we all develop and how to make clearing debt a game…..so important to understanding ourselves better and to staying motivated to become debt free!

Love the honesty in this article and the tips are good.

Thank you for sharing your journey of financial empowerment and the practical tips and trackers!